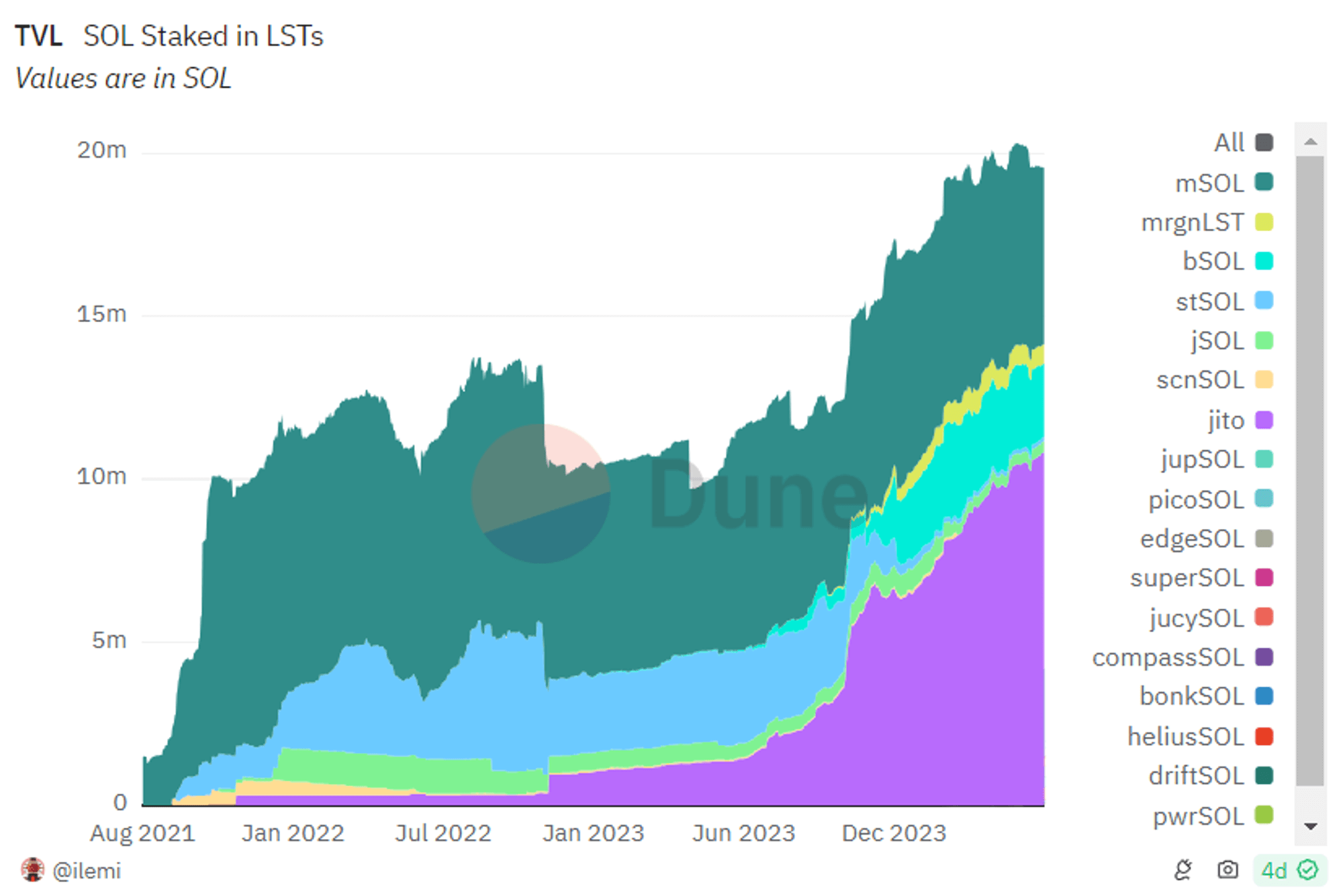

In this article, we’ll be taking a look at the evolving landscape of liquid staking tokens/derivatives (LSTs/LSDs) in the Solana ecosystem, and highlighting some of the top LST protocols currently active in the industry. Over the past few months, we’ve seen a boom of new LST tokens entering the market on Solana, each operating differently, dishing out different rewards to their users. As the LST landscape continues to grow on Solana, it is imperative to know how your LSTs work and how they pay out their rewards.

Understanding Liquid Staking Tokens (LSTs) on Solana

Solana utilizes a consensus mechanism called Proof-of-Stake (PoS), which is run by multiple validators on the network that verify and secure all transactions on the blockchain. These validators then allow users would to lock up their $SOL as collateral, providing network security for Solana in exchange for rewards which are based off the amount of $SOL staked and the time staked.

Unstaking can also be a long process in the eyes of some users, as entities looking to unstake their $SOL will have to wait until the end of an epoch, which is a pre-specified date up to 3 days away. During this time these tokens are staked, they are illiquid and unable to use for other DeFi purposes, which brings us to LSTs.

Liquid Staking Tokens represent a paradigm shift in the token staking realm, aiming to mitigate the inherent limitations of traditional staking mechanisms. Unlike conventional staking, which requires users to lock up their tokens in a network, LSTs offer a liquid form of staked assets. The price of the LST rises relative to SOL each epoch with Solana inflation rewards being accrued into the underlying staked SOL in the chosen LST’s stake pool. This liquidity enables users to trade, lend, borrow, or engage in DeFi activities while still earning staking rewards.

Advantages of Utilizing LSTs

The allure of LSTs lies mainly in their versatility and accessibility, presenting users with a myriad of benefits:

- Flexibility: By converting staked assets into liquid tokens, LSTs grant users the flexibility to actively participate in the DeFi space without sacrificing staking rewards.

- Enhanced Yield: LSTs unlock additional earning opportunities by enabling users to capitalize on staking rewards while simultaneously engaging in DeFi activities, thereby maximizing yield potential.

- Strategic Management: LSTs empower users to strategically manage their staking positions, allowing for dynamic adjustments based on market conditions or personal preferences. V

Exploring the Types of LSTs on Solana

Within the Solana ecosystem, several protocols have introduced distinct variations of Liquid Staking Tokens, each with its own set of features and functionalities. With the release of Sanctum Infinity, many protocols have been introducing new LSTs into the market.

Source (6/09/2024): Dune

Marinade

Entering the industry in early 2021, Marinade was the first entrant into the LST ecosystem on Solana. Marinade is a stake automation platform for Solana, offering both a native and liquid staking solution.

Liquid Staking (mSOL):

- Permissionless delegation formula for 100+ validators

- Enhances security & rewards

- LST able for use in DeFi (mSOL)

- Accrues validator rewards

Native Stake:

- Non-custodial solution w/ automated delegation strategy

- No smart contract risk

- Automatically managed and rebalanced staking position with 0 fees

Jito

In late 2022, the Jito Foundation launched the LSD jitoSOL, which became the first LSD on Solana to accrue both standard validator rewards and MEV rewards. In the announcement blog post by Jito, Anatoly Yakovenko is quoted saying, “MEV is a rapidly growing business model for blockchains. Jito has a great approach to maximize the benefits of MEV to the network and minimize the negative externalities of MEV to the rest of the users and applications running on Solana.”

The jitoSOL stake pool will exclusively delegate its $SOL to validators that run the Jito-Solana validator client, which helps minimize the negative effects of MEV. Since its launch of jitoSOL, the LST has gained tons of traction with the Solana ecosystem, especially following the launch of their governance token $JTO in 2023.

Sanctum

Sanctum has become the latest attraction in the world of LSTs on Solana, following the launch of Sanctum Infinity. With the large amount of LSTs launching on Solana, a need for deep liquidity will be prevalent as we saw in the previous mSOL depeg in late 2023. Sanctum Infinity acts as a multi-LST liquidity pool which allows users to swap between any LST within the pool. Sanctum users can become a liquidity provider by depositing a whitelisted LST into the Infinity Pool, where they receive the $INF token, accruing both staking and pool rewards.

With the launch of Sanctum Infinity, Sanctum aims to be a scalable solution helps LSTs access deep liquidity and be interoperable with one another.

In conclusion, Liquid Staking Tokens represent a necessary aspect of the expansion and growth of DeFi, with staking rewards and liquidity being the main attraction for users. Across various protocols on Solana, LSTs come in diverse forms with multiple reward-bearing tokens being accessible in the ecosystem. As Solana continues to flourish and evolve, LSTs are poised to play a pivotal role in shaping the future of staking and DeFi in the industry.